How to Get a Better Home Loan Rate by Raising Your Credit Score

First Off

One of the main objectives for anyone wishing to purchase a property is to obtain a home loan with a favorable interest rate. Your credit score is one important criterion that might have a big impact on the rate you get. We will look at how you may raise your credit score in order to get a better rate on a house loan in this in-depth article.

A credit score: what is it?

Let’s first define a credit score before getting into the details. Your creditworthiness is expressed numerically by your credit score. It’s a three-digit number, usually in the 300–850 range. Your creditworthiness improves as your score rises.

Why Does Having a High Credit Score Matter?

Because it directly influences the terms and circumstances of loans you can obtain, having a high credit score is crucial. Your credit score is what lenders use to determine how risky it is to lend to you. Over the course of your house loan, a higher credit score frequently translates into cheaper interest rates, which might save you a sizable sum of money.

Recognizing the Effect

Let’s look at an example to help you understand how your credit score affects you. A mortgage with an 8.35% interest rate may be available to borrowers with a credit score of 760. However, the interest rate may be as high as 9.50% if your credit score is 620. The variation in interest rates may cause

How is the score on your credit determined?

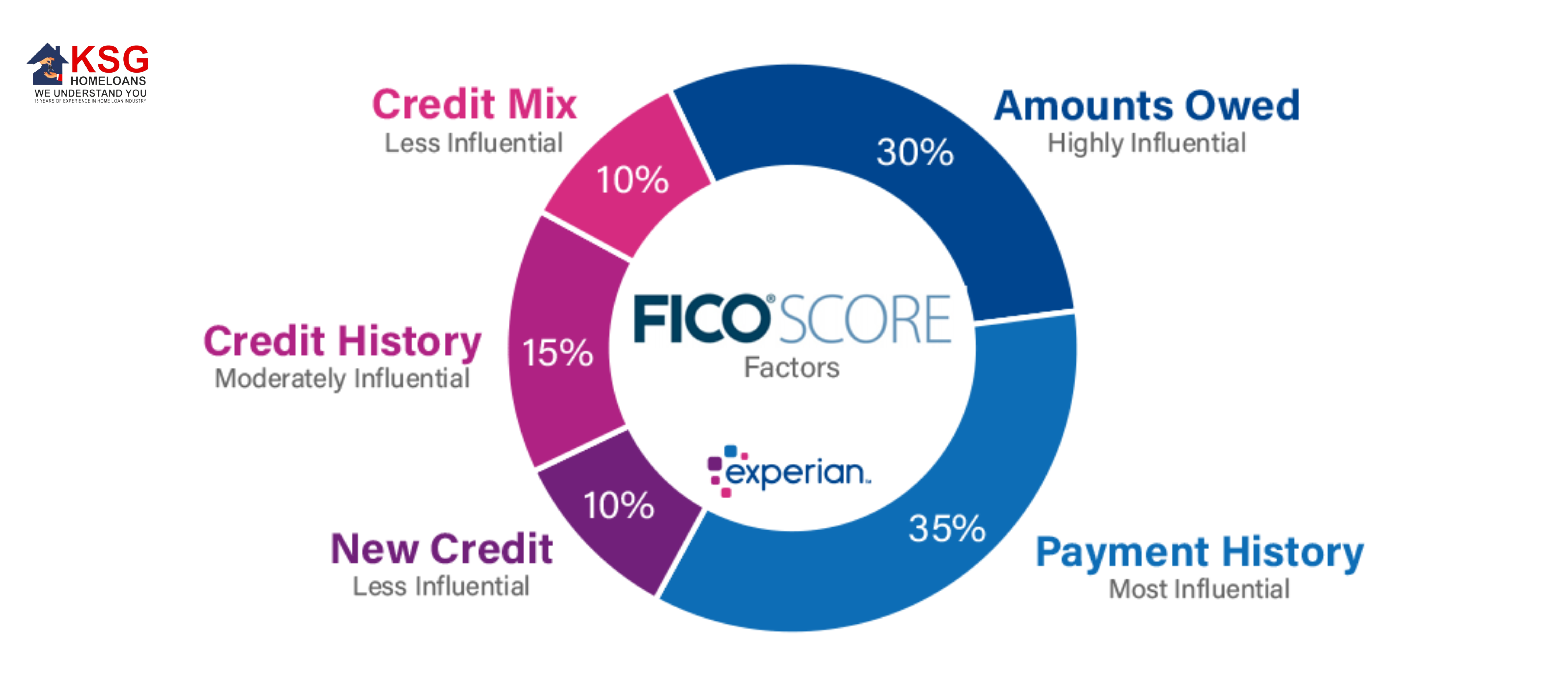

The first step to raising your credit score is knowing how it is determined. FICO is the most popular scoring model, and it considers a number of variables. These consist of your credit mix, credit history duration, payment history, credit utilization, and recent credit applications.

Examining Your Credit History

To raise your credit score, you must be aware of your current situation. Get a copy of your credit report from TransUnion, Equifax, and Experian, the three main credit bureaus. Each bureau is permitted to provide you with a complimentary copy once a year. Examine the correctness of the report and look for any inconsistencies.

Recognizing and Fixing Mistakes

Your credit score may suffer if there are mistakes on your credit report. Make a dispute with the credit bureau if you discover errors so they can be fixed. Just completing this step can significantly raise your score.

Pay your invoices promptly

Your payment history is one of the most important components that determines your credit score. Develop the habit of paying all of your bills—credit cards, loans, and other debts—on time.

Diminish Credit Card Amounts

Your credit score may suffer if you have large credit card debt. Try to limit the amount on your credit cards to no more than 30% of your credit limit. This exemplifies prudent credit management.

Keep Open Old Accounts

It matters how long your credit history is. Your credit history may be shortened by closing previous credit accounts, which could be detrimental. To keep your credit history longer, keep your previous accounts open.

Avoid Opening a Lot of New Accounts

Creating a lot of new credit accounts in a short amount of time can be viewed as dangerous activity. It’s a good idea to restrict how many new accounts you open in a given year.

Credit Matter Types

Your credit score can be improved by having a variety of credit, including mortgages, installment loans, and credit cards.

Averting Tough Questions

Lenders run hard queries when you apply for credit. A high number of hard inquiries in a brief period of time can lower your credit score. When applying for new credit, exercise caution.

Remain Calm and Relentless

It requires patience and persistent work to raise your credit score. Remain patient and keep up your excellent credit practices.

Track Your Development

To keep tabs on your progress, periodically check your credit report and credit score. You can do this with the assistance of several web services.

In summary

Over time, a lower interest rate on your home loan could result in thousands of dollars in savings thanks to a higher credit score. By doing these things and keeping up with good credit practices, you can improve your creditworthiness and get a better deal on a house loan.